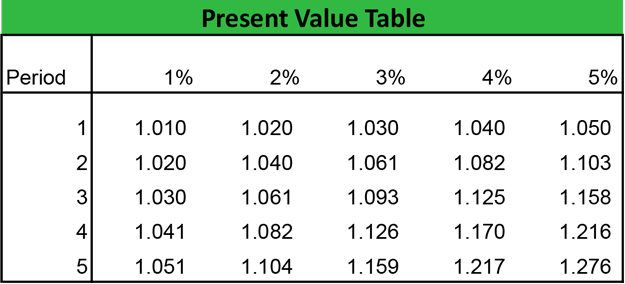

Present value of lump sum table

Generally for plan years beginning after December 31 2007 the applicable interest rates under Section 417 e 3 D of the Code are segment rates. The tables are used together with other actuarial assumptions to calculate the present value of a stream of expected future benefit payments for purposes of determining the.

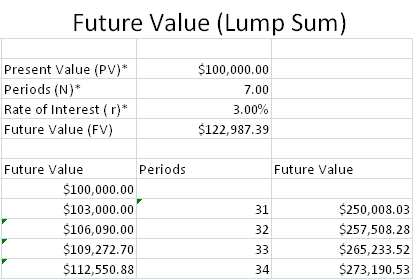

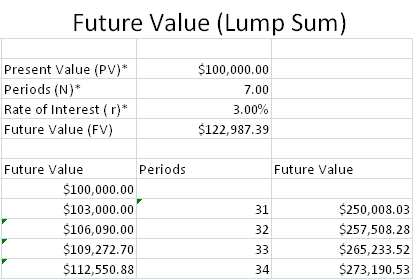

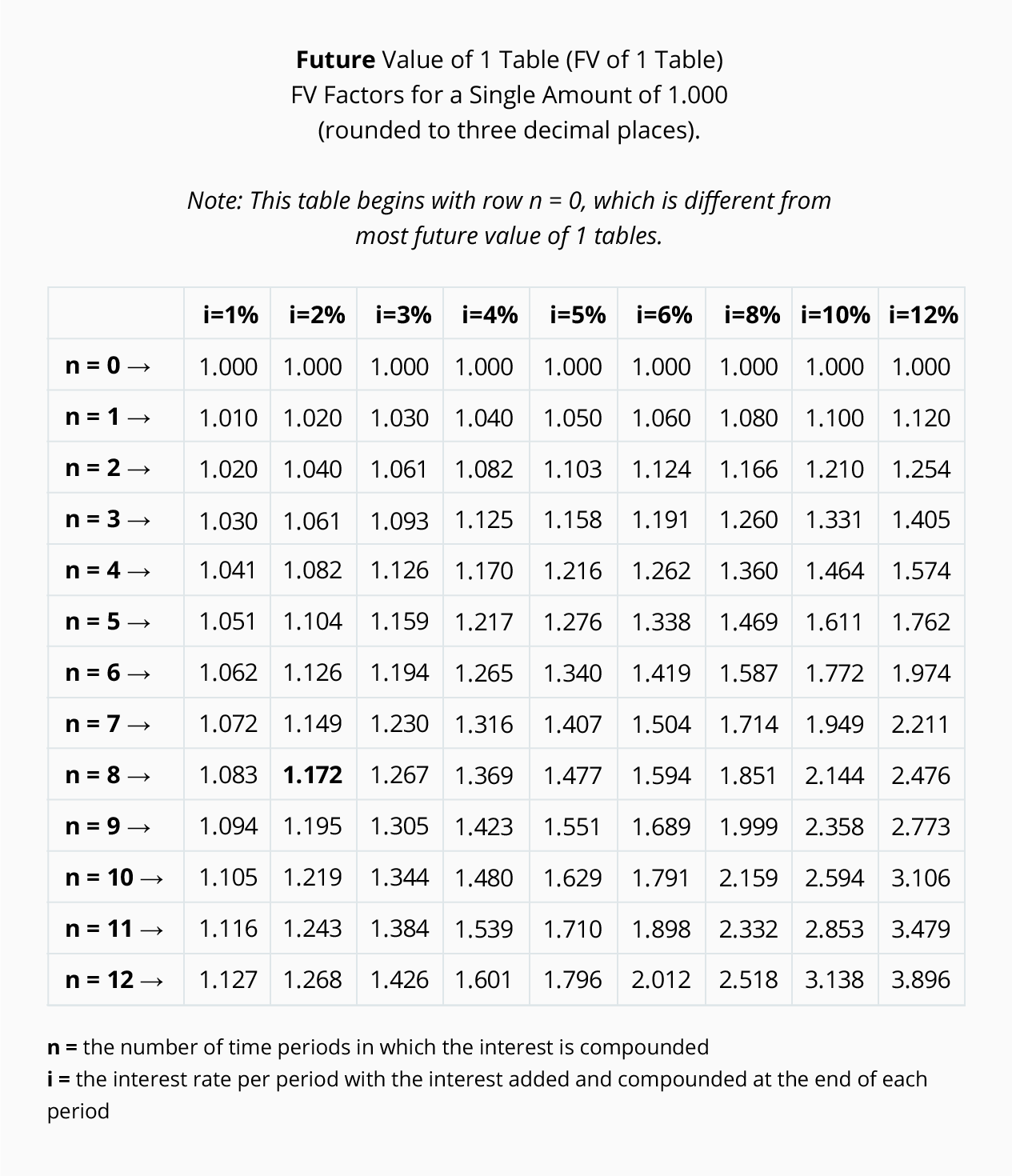

Future Value Of A Lump Sum

Specifically a db plan as defined in irc 411 a 13 may define the present value of the participants accrued benefit under a lump sum-based formula as the current hypothetical.

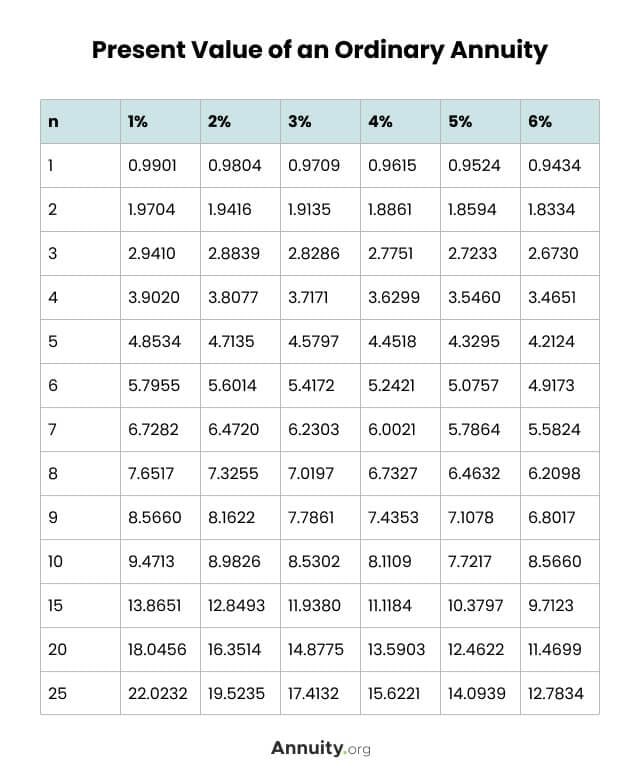

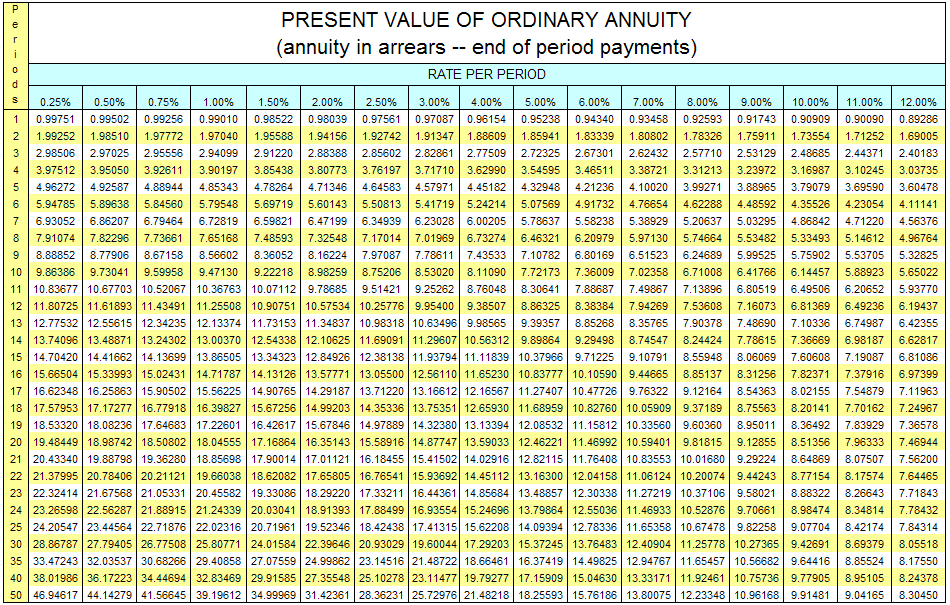

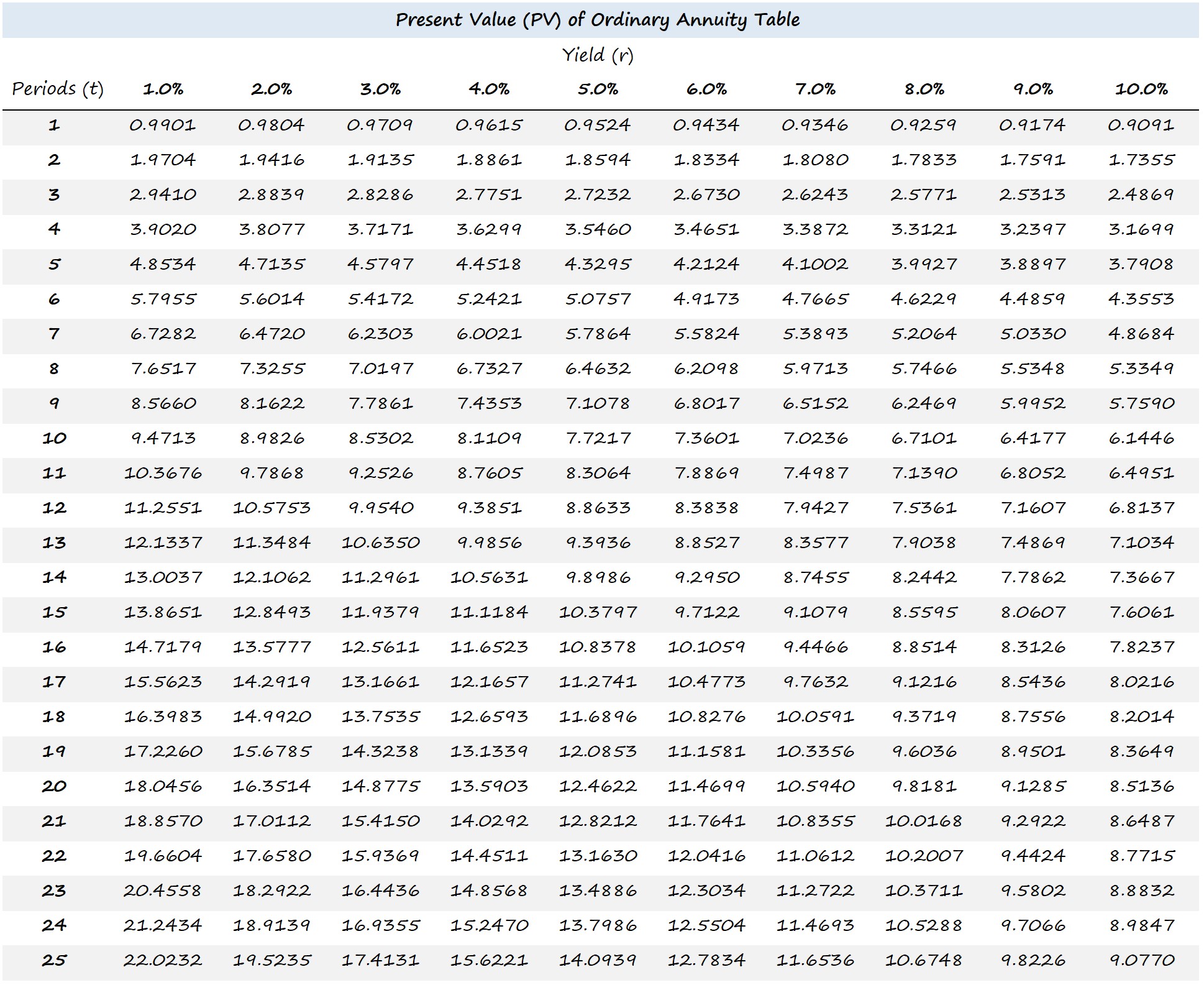

. Purpose Sum numbers in a range that meet supplied criteria Return value The sum of values. Heres an easy way to look at present value. One set for lump sums and one set for annuities.

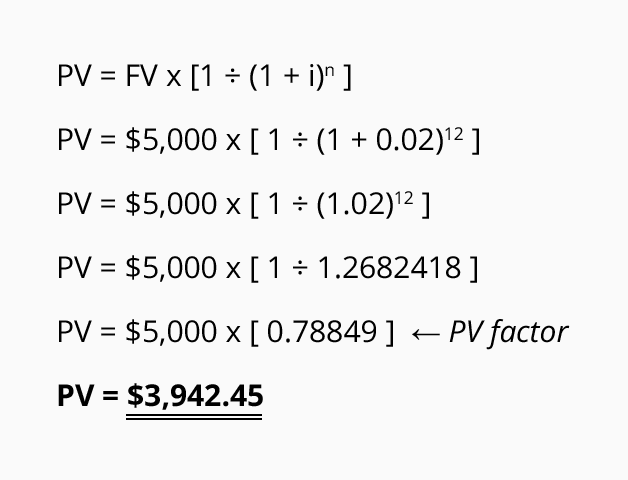

The formula for calculating PV in Excel is PV rate nper pmt fv type. Finding the present value of a lump sum using Excels PV function. Click on the cell in your table where you want to see the total of the selected cells.

Using the IRS Minimum Present Value Segment Rates for May 2022 the first segment is 323 the second segment is 459 and the third segment is 469. Minimum Present Value Segment Rates. TRUE Money received today is worth more than the same amount of money received.

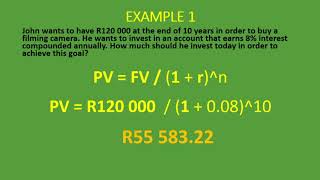

Thus if you expect to receive a payment of 10000 at the end of four years and use a discount rate of 8 then the factor would be 07350 as noted in the table below in the. If we calculate the present value of that future 10000 with an inflation rate of 7 using the net present value calculator above the result will be 712986. Present Value of Lump Sum Compounded Annually and Compounded QuarterlyhttpsyoutubecCPyfWR7IS0.

The loan is a ten-year note so we need to figure out what the present value of a 150000 lump sum is ten years from now. As you can see the PV of the balloon payment is 5783149. Key Takeaways Present value PV is the current value of a stream of cash flows.

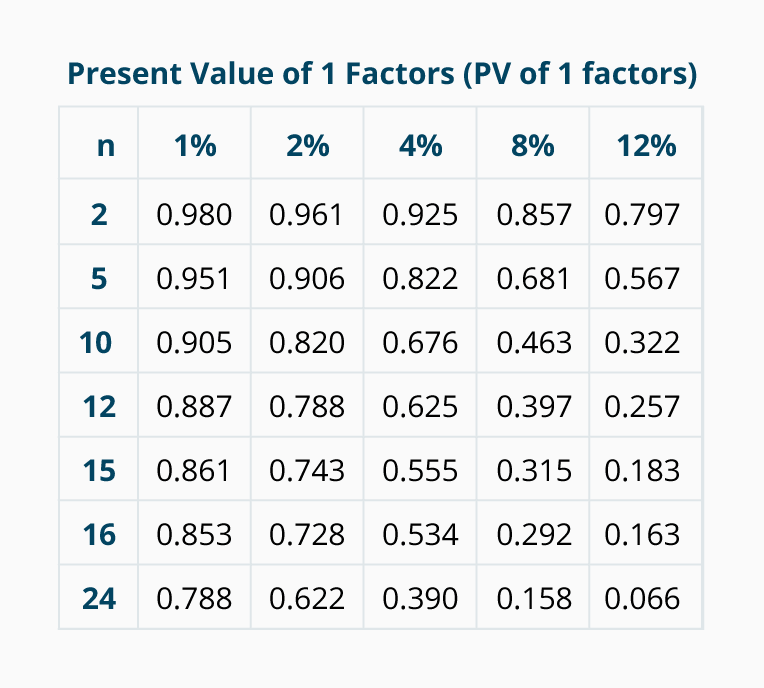

Under section 430 d 1 a plans funding target for a plan year generally is the present value of all benefits accrued or earned under the plan as of the first day of that plan. Lump - sum payouts are calculated by determining the present value of your future monthly guaranteed pension income using actuarial factors based on age mortality tables published. There are two sets of present and future value tables.

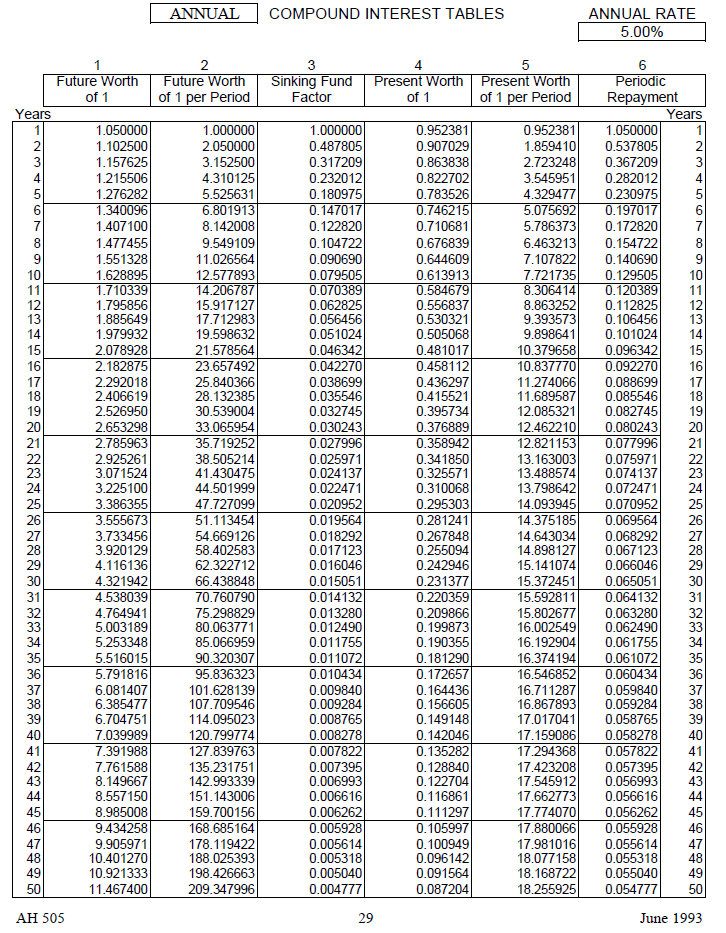

Table A-2 Future Value Interest. If you invest 1000 in a savings account today at a 2 annual interest rate it will be worth 1020 at the end of one year. Present Value and Future Value Tables Table A-1 Future Value Interest Factors for One Dollar Compounded at k Percent for n Periods.

73601 Balance Accumulation Graph Principal Interest Balance 0 25 5 75 10 0 500 10K 15K Breakdown 76 24 Principal Interest Schedule Related Investment. What that means is the discounted. FVIF kn 1 k n.

Calculating Present Value Accountingcoach

What Is An Annuity Table And How Do You Use One

Present Value Formula Calculator Annuity Table Example

Annuities Amortization Present Value Lump Sum Payment And Balance Due Anil Kumar Lesson Gcse Ibsl Youtube

Lottery Winner S Dilemma Lump Sum Or Annuity

Ordinary Annuity Formula Step By Step Calculation

Present Value Formula Lump Sum Single Amount Formula With Examples Youtube

Future Value Factors Accountingcoach

Present Value Of A Single Amount Quiz And Test Accountingcoach

Solved The Table Shows The Lump Sum Amount Of Money Chegg Com

Present Value Of A Lump Sum Formula Double Entry Bookkeeping

Annuity Present Value Pv Formula And Excel Calculator

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Time Value Of Money Board Of Equalization

Lump Sum Present And Future Value Formula Double Entry Bookkeeping

Present Value Formula And Pv Calculator In Excel

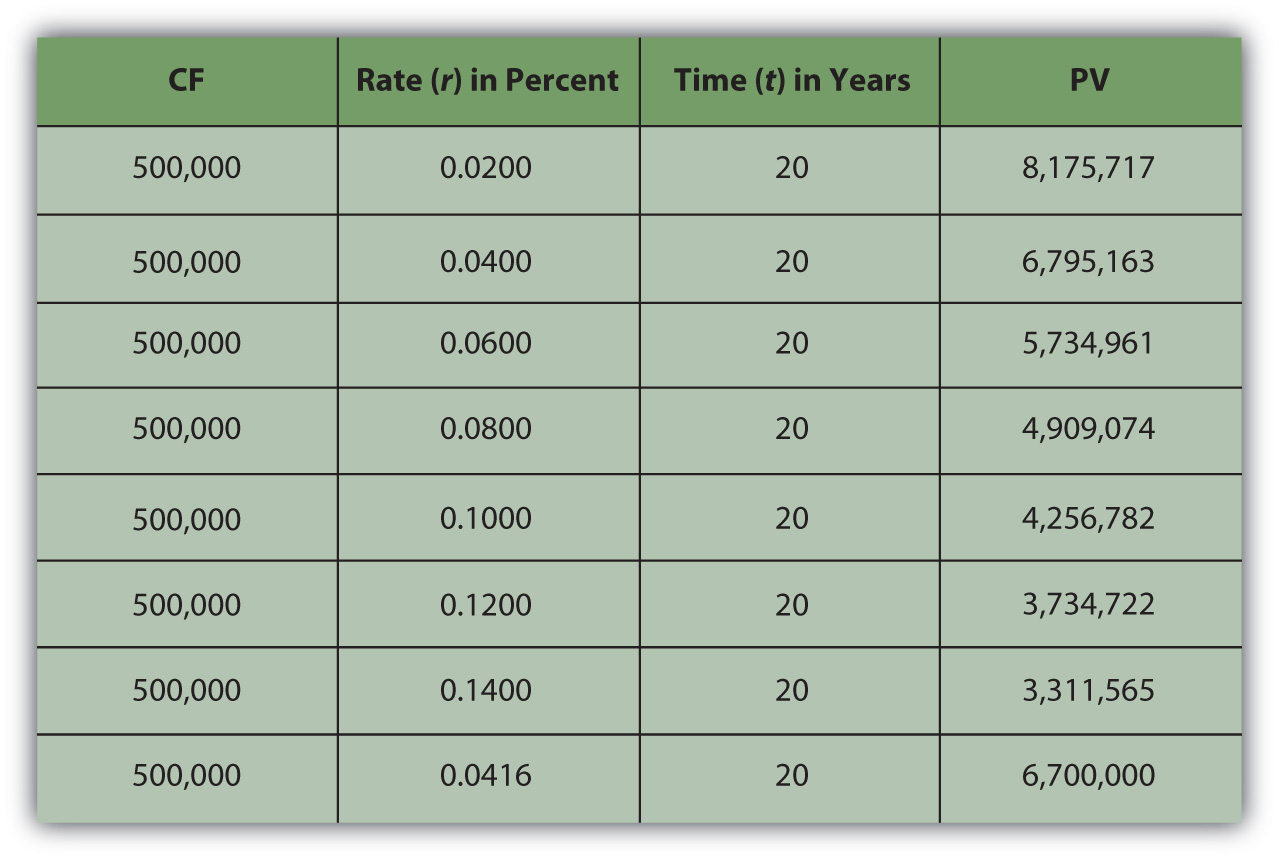

Valuing A Series Of Cash Flows